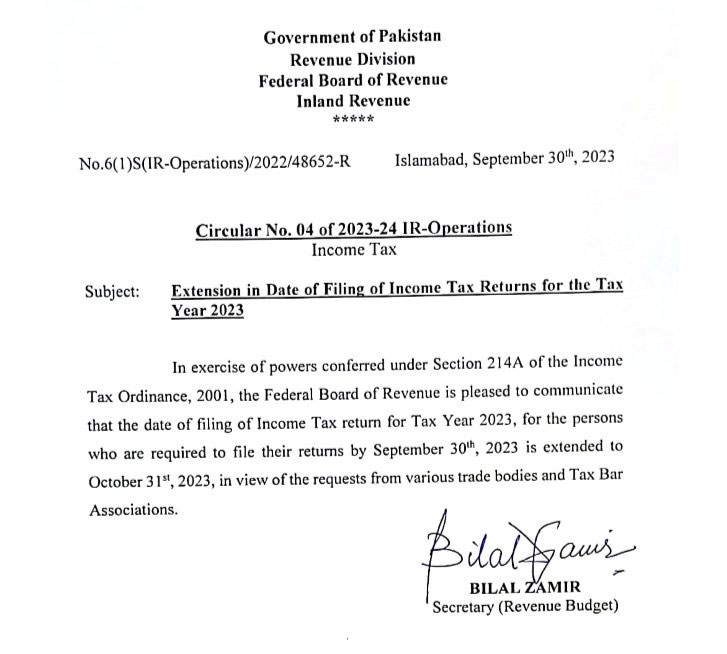

The Federal Board of Revenue (FBR) announced on Saturday that the last date for submission of income tax returns for the tax year 2023 has been extended to October 31, 2023.

The country’s top tax-collection body also stressed that no further extensions would be given.

The decision to extend the deadline was made in response to requests from trade bodies and various tax bar associations, the revenue board said.

“Due to the demands from trade bodies and tax bar associations, the deadline for filing income tax returns for Tax Year 2023 has been extended to October 31, 2023,” the FBR officially conveyed this update via social media platform X (formerly Twitter) on Saturday.

“However, it is essential to note that no additional extensions will be provided, it concluded.

FBR officials reported that over 1.7 million individuals had already submitted their tax returns. They also said that the number is expected to surpass the two million mark by September 30.

A couple of days ago, the federal body had made the decision not to extend the deadline for tax return submissions, which was initially set for September 30.

The tax slabs for year 2022-23 approved by the former government are:

- For income below Rs600,000 per year (Rs50,000 per month) — no tax will be deducted

- Those earning Rs600,000 to Rs1.2 million per year (Rs50,000 to Rs100,000 per month) will pay a tax of 2.5% of the amount exceeding Rs600,000

- On the income within a range of Rs1.2 million to Rs2.4 million (Rs100,000 to Rs200,000 per month) will pay Rs15,000 plus 12.5% of the amount exceeding Rs1.2 million

- Individuals earning Rs2.4 million to Rs3.6 million a year (Rs200,000 to Rs300,000 per month) will be charged at Rs165,000 plus 20% of the amount exceeding Rs2.4 million

- Those earning Rs3.6 million to Rs6 million a year (Rs300,000 to Rs500,000 per month) will be charged at Rs405,000 plus 25% of the amount exceeding Rs3.6 million

- People with an annual income of Rs6m to Rs12 million (Rs500,000 to 1,000,000 per month) will be charged at Rs1.005 million plus 32.5% of the amount exceeding Rs6 million

- In the last slab, individuals earning more than Rs12 million (more than 1,000,000 per month) a year will be charged at Rs2.955 million plus 35% of the amount exceeding Rs12 million

The then-finance minister, Miftah Ismail — while announcing the federal budget for the fiscal year 2022-23 — revealed the FBR’s target for the financial year is 9% — Rs7,004 billion.